Will Cattle Prices Correct Lower?

The 2025 peak grilling season began on the Memorial Day weekend and will run through early September when the Labor Day holiday marks the end of the summer. Grills are working overtime as those burgers, steaks, and hot dogs fill the summer air with aromas making carnivore’s mouths water.

I asked if cattle were on a path to even higher prices in a May 8 Barchart article, where I concluded:

The trend is always your best friend in markets across all asset classes. In the cattle world, the beef market is entering its peak demand season at the end of May. The annual grilling season runs through early September, when consumption and prices tend to rise to annual highs. However, the path of least resistance of live and feeder cattle prices over the past five years has ignored seasonality and has been on a one-way street higher. The odds favor higher highs in the cattle arena over the coming weeks and months.

Nearby live cattle futures were trading at $2.1150 per pound on May 7, with the feeders at the $2.97 per pound level. In June, prices were higher after reaching new record peaks.

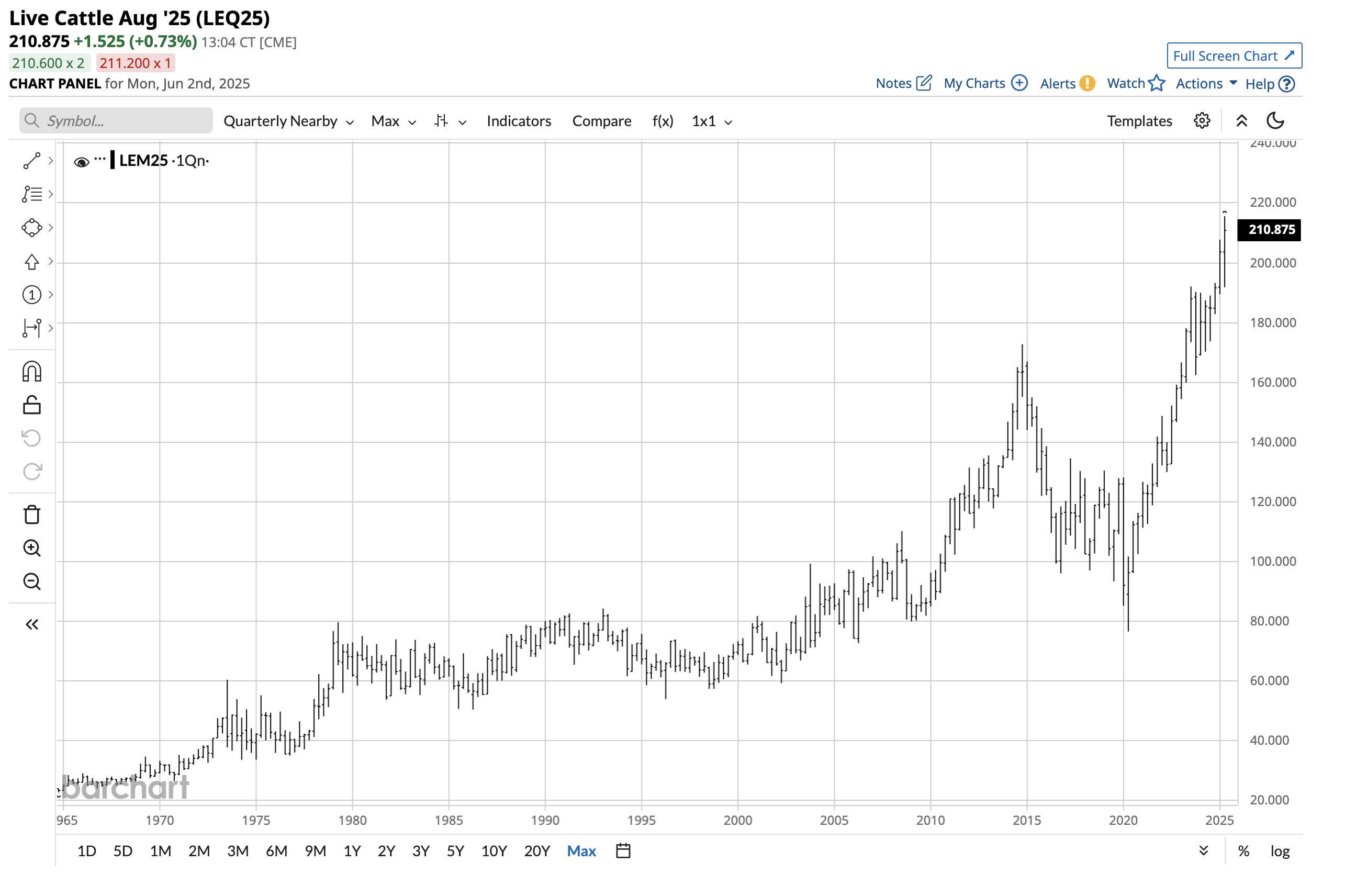

Live cattle continue to make higher highs

The live cattle futures contract reached a new record high in May 2025.

The quarterly chart highlights the bullish trend that continues to take live cattle futures to new all-time highs. In May 2025, the price reached $2.1560 per pound, over 2.8 times higher than the pandemic-inspired 2020 low.

The feeders eclipse the $3 per pound level

Feeder cattle futures have been on the same bullish path.

The quarterly feeder cattle futures chart illustrates the rise to over $3 per pound in May, reaching a high of $3.07675 per pound, nearly three times the 2020 low of $1.03625, which was pandemic-inspired.

While the fat and feeder cattle futures have declined from their May 2025 peaks, the trends in both cattle futures markets remain bullish at the start of the 2025 grilling season.

How high can beef prices rise?

Commodity cyclicality tends to take prices to sustainable lows and highs during trends. On the downside, prices often decline to levels where production decreases, inventories begin to fall, consumers increase their purchases, and prices eventually find a bottom. On the upside, prices can rise to levels where production increases, inventories begin to increase, and consumers seek substitutes or limit purchases, leading to price tops.

Agricultural commodities can be particularly unique in terms of cyclicality, as weather, crop or animal diseases, or other factors can cause significant price volatility. In the cattle market, the Trump administration tariffs, the legacy of the 2020 pandemic, and inflationary pressures have created an explosive bullish trend.

Picking tops in any market is dangerous as prices can rise to levels that defy rational, logical, and reasonable technical and fundamental analysis. We have witnessed other commodities experience parabolic rallies, taking prices to levels far above forecasts. Gold, coffee, cocoa, and frozen concentrated orange juice futures are examples of commodities that have extended even the most bullish forecasts over the past months.

The offseason will begin to impact prices

The 2025 peak grilling season will keep beef demand high over the coming weeks and months, but it will likely end after the Labor Day weekend holiday in early September, when many barbecues are put back into storage after summer and beef and other animal protein demand tend to decline, pushing prices to seasonal lows. Therefore, the odds and historical seasonal trends favor lower prices later this summer as the animal protein markets shift to off-season demand dynamics.

Meanwhile, the long-term cattle charts indicate that seasonality has not affected prices during the offseason since 2020, as beef demand has remained robust with ongoing supply issues.

Futures are the only avenue for exposure to cattle prices

The only avenue for exposure to live and feeder cattle prices is through the CME’s futures and futures options contracts. Futures and futures options are leveraged instruments that require unique futures accounts.

Each live cattle futures contract has 40,000 pounds. At $2.10 per pound, each contract value is $84,000. The original margin requirement is currently $3,025 per contract, representing 3.6% of the contract value at the current price. The CME requires a maintenance margin payment if the long or short equity drops below $2,750 per contract.

Each feeder cattle futures contract has 50,000 pounds. At $3 per pound, each contract value is $150,000. The original margin requirement is currently $4,537 per contract, representing 3% of the contract value at the current price. The CME requires a maintenance margin payment if the long or short equity drops below $4,125 per contract.

Given that the end of the 2025 grilling season is in early September, the odds of a seasonal correction will rise. However, picking a top in the live and feeder cattle futures is dangerous as the price has continued to make higher lows and higher highs since the 2020 lows.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.